Portfolio Management Powered by AI

Implementing machine learning to help us save time, improve portfolio metrics, and make better, data-driven decisions.

How AI is helping us drive success

AI-Backed Models

We partnered with an artificial intelligence software company for portfolio managers to create three proprietary models driven by AI.

This approach combines human intelligence with machine capabilities, which can reduce biases while keeping an experienced portfolio manager in the driver’s seat.

Machine learning actively identifies and learns from patterns, understands market dynamics, and makes predictive analyses that can inform investment strategies.

With AI’s ability to continuously learn from new data and adapt strategies to changing market conditions, we believe this approach differentiates itself from other quantitative strategies.

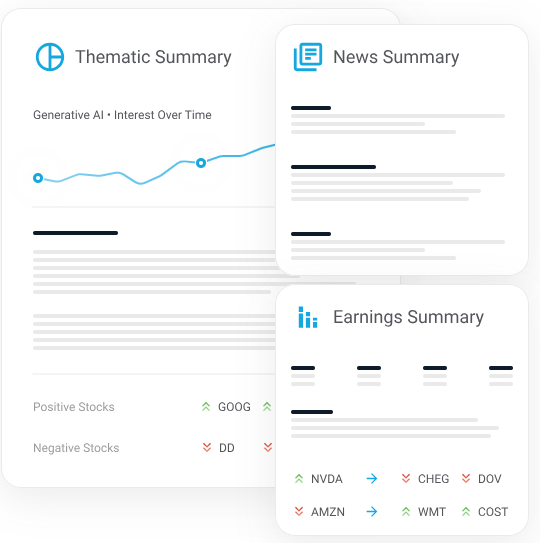

Curated Research

We create custom watchlists to help us understand at a glance both positive and negative impacts to our stocks, in addition to staying on top of any ratings changes or potential sector shifts.

1. ETF | Stock Hybrid

65% ETFs | 35% Stocks, Rebalanced Semiannually

Designed to outperform the S&P 500

2. US Top 500 Tactical

100% Stocks | Avg. Annual Turnover of 49%

Portfolio Construction: 70% Fundamental

22% Technical, 8% Macro

3. US Large-Cap, Low Turnover

100% Stocks | Avg. Annual Turnover of 31%

Portfolio Construction: 80% Fundamental, 20% Technical

Added Conviction

Substantiate top-of-house recommendations by cross-referencing with our AI software.

Analyze thousands of individual stocks on both a qualitative and quantitative level.

Help our team make sense of what’s really driving the market:

Marco themes

Performance attribution

Market breadth